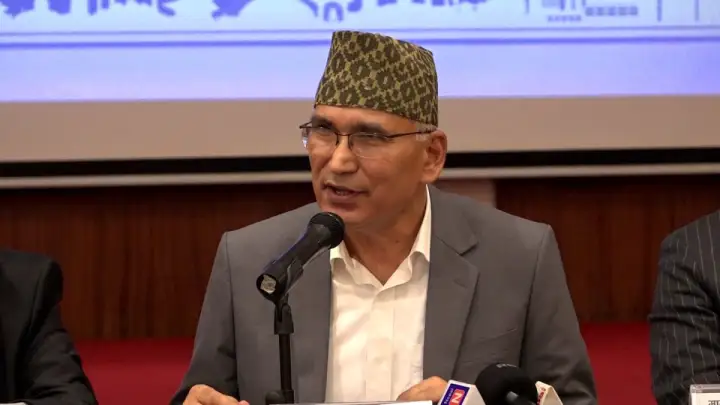

Kathmandu – Deputy Prime Minister and Finance Minister Bishnu Prasad Paudel has expressed concern that despite the availability of liquidity in banks and decreasing interest rates, loans are not being disbursed as expected. During a meeting with officials from the Nepal Chamber of Commerce, Minister Paudel highlighted a downturn in key economic indicators such as demand, production, capital expenditure, and revenue in the market.

Minister Paudel emphasized that the government’s primary challenge is to restore confidence in the private sector, as the lack of lending is causing significant concern. He noted that industrialists are more focused on sustaining their existing businesses rather than investing in new ventures, which has contributed to the stagnation in loan disbursement.

Acknowledging the vital role of the private sector in the country’s economy, Finance Minister Paudel stated that the government is committed to boosting confidence within the sector. He reassured that the government would take effective measures to address the challenges faced by the private sector, provided there is mutual trust and confidence between the two parties.

Minister Paudel called on the private sector to have faith that the sluggish and contracting economy can be revitalized. He affirmed that the government, acting as a guardian to all, would play a supportive role in this effort.

During the meeting, the Nepal Chamber of Commerce raised concerns about the ongoing contraction in economic activities, the imbalance between demand and supply, and the reduction in private sector assets and liquidity in banks and financial institutions. Despite the availability of liquidity, there is a lack of investment interest from the private sector.

The Chamber urged the government to consider rescheduling loans for entrepreneurs at risk of being placed on the bad debt list, taking into account the specific nature of their businesses. The Chamber believes that rescheduling loans could significantly boost confidence among business owners, potentially preventing many from facing bankruptcy.

About Us

About Us

Comment