Kathmandu – Nepal Rastra Bank (NRB) has made a significant decision to distribute clean and well-maintained banknotes instead of new ones during this year’s Dashain festival. In previous years, NRB had distributed new notes for Dashain celebrations, but this year, the bank has opted for a change. The decision is aimed at saving state funds, which would otherwise be spent on printing new notes annually.

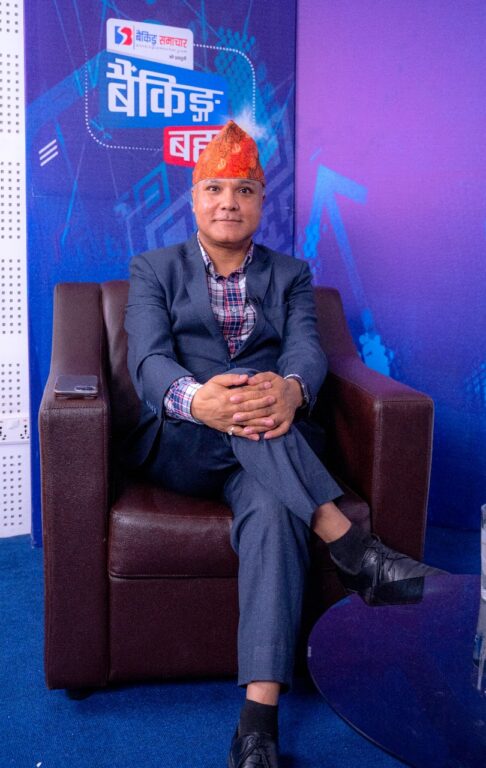

In an interview with Banking News, NRB’s Deputy Governor, Bam Bahadur Mishra, explained the reasons behind this shift. Here’s an edited excerpt from the conversation:

Why has NRB decided not to distribute new notes this Dashain? How will this affect the sentiments and traditions of the festival?

NRB has been distributing new notes during Dashain and Tihar for ceremonial purposes. However, this year we decided to distribute clean and well-maintained banknotes instead. There are several reasons for this shift, and we’ve been preparing for it for the last two years.

Previously, NRB would issue new notes in denominations of 5, 10, 20, 50, 100, 500, and 1000 during Dashain. After the festival, people would use these new notes for transactions, and by December or January, these notes would return to the banks, often dirty and stained. Once these notes returned, they weren’t reused, which led to the need to print new notes every year. This practice cost the government a significant amount of money.

By distributing clean notes, we estimate that the state can save up to NPR 2 billion annually. Additionally, by not issuing new retail notes, we hope to encourage the use of digital payments.

There is some confusion in the market about whether NRB will print new notes for Dashain or just distribute clean ones. Could you clarify?

NRB has a specific criterion for how much money to print each year, and it does so at different times. The decision to print new notes isn’t made overnight. This year, we decided not to distribute new notes specifically for Dashain, but we haven’t ruled out printing notes at other times. We have sufficient clean notes in denominations of 5, 10, 20, and 50 to meet the demand.

But there are no new notes of NPR 100, and the previous government had approved notes with the new map featuring the disputed territories. Is there a geopolitical dimension to this?

No, that’s not the case at all. NRB has its own criteria for deciding what denominations and how much money to print. The decision not to issue new notes for Dashain is unrelated to any geopolitical issues. We are also implementing a clean note policy, which ensures that we distribute clean notes to banks.

Moving on to another topic: NRB has been promoting digital transactions. But with a transaction fee of NPR 10 plus VAT, digital payments can be costly for regular users. How does this align with your goal of encouraging digital transactions?

Yes, there is a cost involved in digital transactions, but we are actively promoting it through Payment Service Providers (PSP) and Payment Service Operators (PSO). For Person-to-Person (P2P) transactions, a fee is charged, but Person-to-Merchant (P2M) transactions are free of charge. While it’s true that no service is entirely free, we believe this approach encourages more digital transactions, especially for P2M.

The government has also imposed VAT on digital transactions starting this year, which is a matter of law. Discussions about reducing transaction fees are ongoing, but free services are generally not sustainable.

There has been criticism about NRB’s role in raising interest rates and its impact on investments. How do you respond to these concerns?

NRB doesn’t implement policies to favor or hinder anyone; our goal is financial stability. The recent interest rate hikes were part of a global trend, with central banks in India, China, the EU, the UK, and the US all tightening their monetary policies. Interest rates globally have risen, and NRB had to follow suit. However, we’ve already begun lowering interest rates, and we are now focusing on easing conditions for investments.

Lastly, there’s been criticism that NRB changes its policies with each new government. How do you address allegations that NRB is acting under political influence?

That’s simply not true. NRB works in alignment with the government’s fiscal policies but operates independently. There have been no disputes between NRB and the Ministry of Finance. Our policies are designed to ensure the country’s financial stability, not to favor any government.

In summary, while NRB has faced criticism for various decisions, including interest rate policies and its approach to printing new notes, the central bank maintains that its actions are in the best interest of the country’s financial health. NRB’s focus on saving costs through clean note distribution and promoting digital payments is part of its broader effort to modernize Nepal’s financial system.

About Us

About Us

Comment