Pioneering Change in Insurance and Reinsurance

Lexasure Financial Group, a leading name in the insurance and reinsurance industry, is redefining risk management through digital innovation. With operations spanning Asia and North America, the company is committed to creating an insured future for the world by offering tailored solutions that empower businesses to grow boldly.

Under the visionary leadership of CEO Ian Lim, Lexasure leverages cutting-edge technology and industry expertise to address critical challenges and opportunities in the insurance landscape.

Subsidiaries Driving the Mission

Lexasure operates through three key subsidiaries, each playing a unique role in its overarching vision:

- Front Street Re: Specializing in life and general reinsurance, this subsidiary offers annuities, life, health, medical, and long-term care solutions. Acquired in 2021, its milestone achievements include establishing a general reinsurance division in 2022.

- The Archipelago Group: Founded in 2013, it provides a comprehensive range of services, including general insurance, life insurance, and Takaful products. The group focuses on inclusivity and meeting the diverse needs of regional markets.

- Acurra Group: Established in 2004, Acurra specializes in managing high-value and complex risks across Asia, offering expertise in international reinsurance broking and captive management.

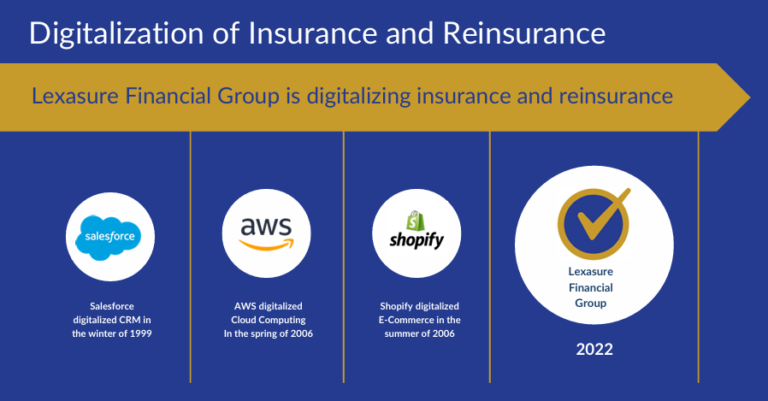

Digital Transformation in Insurance

At the heart of Lexasure’s strategy is its innovative approach to digital transformation. Through its LexasureCloud platform, the company empowers insurers with a scalable, cloud-based Insurance-as-a-Service (IaaS) solution that enhances operational efficiency and customer experiences. This platform enables even small and medium-sized insurers to compete effectively in dynamic markets.

Lexasure’s Reinsurance-as-a-Service (RaaS) model further demonstrates its commitment to leveraging InsureTech advancements, offering unparalleled support to clients while addressing localized challenges in fast-growing Asian markets.

Tackling Asia’s Insurance Gaps

With 90% of recurring disaster risks in Asia uninsured, Lexasure is at the forefront of addressing this critical gap. By offering customized risk management solutions and promoting digital insurance products, the company is building a safer, more resilient future for the region.

Visionary Leadership and Expertise

Lexasure’s leadership team boasts over 150 years of combined experience in insurance, reinsurance, technology, and finance:

- Richard Goh, Chairman: Brings over 40 years of industry experience.

- Ian Lim, CEO: An industry veteran with 25+ years of expertise in reinsurance underwriting.

- Adrian Tay, CFO: Expert in corporate finance and governance with 20+ years of experience.

- George Nicholson, CRO: Renowned for his 40 years of risk management expertise.

- Vincent Kwo Beng Ghee, CTO: Leads technological innovation with 35+ years of experience in insurance and technology.

Future Outlook

With milestones like the launch of LexasureCloud and expanding digital insurance products, Lexasure is poised for continued growth. The company remains dedicated to its mission of enabling businesses and individuals to live and grow boldly, addressing Asia’s unique insurance needs with a customer-centric and innovative approach.

Lexasure Financial Group is more than an insurance company, it is a transformative force driving the future of the insurance and reinsurance industry. With its commitment to innovation, scalability, and localized solutions, Lexasure is paving the way for a brighter, more insured world.

About Us

About Us

Comment