Banking News – Prabhu Bank has come under fire for increasing the annual renewal fee for its mobile banking service without notifying its customers. The bank reportedly raised the fee by up to NPR 100, deducting the amount directly from customer accounts without prior consent or information.

According to Nepal Rastra Bank (NRB) regulations, banks are required to inform clients in advance about any changes in service charges, particularly for services like mobile banking. Customers must be notified through official communication channels, and in many cases, banks are expected to collect formal consent through forms or digital acknowledgement.

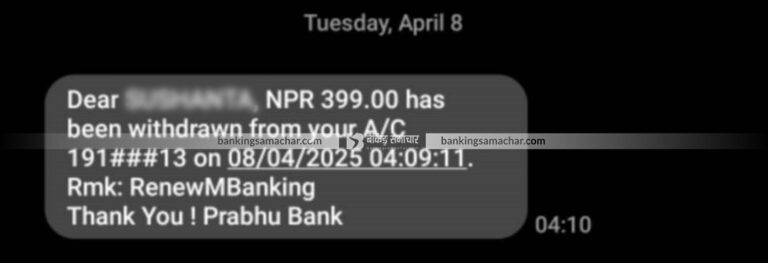

However, customer Sushant Century told Banking Samachar that Prabhu Bank renewed his mobile banking service without any prior notice or approval, automatically deducting the increased amount from his account. He claims that the bank acted without seeking his permission, violating both transparency and consent norms.

The controversy doesn’t stop at the lack of notification. Until last year, the bank charged a specific renewal fee, but this year, it abruptly increased the amount without informing its users. Normally, financial institutions are expected to update such information on their official websites, detailing fees and service charges.

Prabhu Bank had earlier listed the mobile banking annual renewal fee as NPR 300 on its website in 2023. However, it is currently deducting NPR 400 from customer accounts, a hike implemented without user consent or public notice.

When contacted, the bank confirmed the fee had been revised recently from NPR 300 to NPR 399 per year. When questioned about the outdated information on their website, officials responded, “The decision was made recently, and we haven’t had the chance to update the site.”

As a publicly listed company directly connected to millions of depositors and investors, such an irresponsible move has left many customers frustrated. Despite complaints lodged with Nepal Rastra Bank, critics allege that Prabhu Bank has been leveraging its influence to deflect regulatory actions. The bank’s unilateral decision to increase fees and auto-renew services without customer approval has raised serious concerns about customer rights and banking accountability.

About Us

About Us

Comment