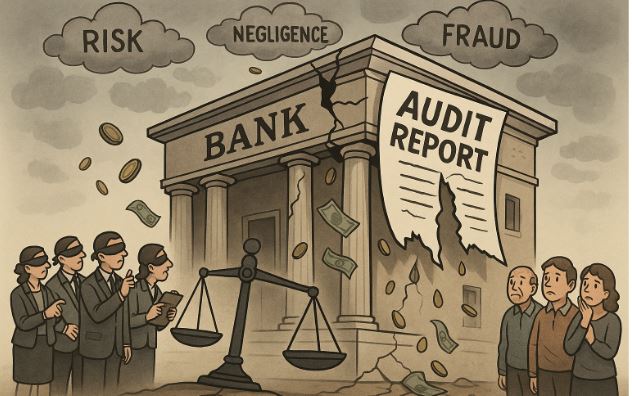

Banking News – Nepal’s banks and financial institutions appear to be increasingly neglecting audit procedures, raising serious concerns about financial stability, according to the latest Bank Supervision Report by Nepal Rastra Bank (NRB).

The central bank states that audit committees in several banks have failed to fulfill their duties as outlined under the Bank and Financial Institution Act, 2016 (2073 BS), the Companies Act, and NRB’s Unified Directives. These duties include reviewing the proposed annual budget and recommending a list of three external auditors for appointment. However, such practices are not being adequately followed.

NRB further notes that some banks lack sufficient manpower to carry out effective auditing functions. In violation of regulatory provisions, certain banks have recommended only one auditor for approval at their annual general meetings, instead of the required three.

Moreover, many banks have not implemented policy-level audits through their internal audit departments. Information security and system audits are also not being conducted in accordance with NRB’s guidelines. The report adds that audit committees are failing to provide adequate directives to audit departments based on internal and external audit findings, resulting in recurring issues.

While internal audit departments are performing risk-based audits, their scope of work, staffing needs, audit processes, reporting systems, and follow-up mechanisms require significant improvements. Additionally, off-site remote auditing practices are absent in some institutions.

Experts warn that such negligence in auditing, especially by institutions as sensitive as banks, could severely undermine financial stability. Despite NRB’s strengthened monitoring of audit procedures, banks continue to engage in non-compliant activities that risk the entire financial system. A lack of transparency in audits also raises doubts about the reliability of financial statements and ultimately affects public trust in banks.

About Us

About Us

Comment