Kathmandu – As loan recovery continues to trouble Nepal’s banking sector, the issue is now escalating with loans disbursed through “phone loans” a digital credit service.

To align with digitization trends, banks and financial institutions had recently begun offering phone loans, allowing customers to access credit quickly and conveniently via mobile apps. The simplicity of obtaining loans through smartphones initially helped attract a significant number of borrowers.

However, the expansion of phone loan services has brought new challenges. While many customers repay their unsecured digital loans on time, a growing number of delinquent borrowers are causing substantial recovery issues for banks. Since phone loans are often disbursed without collateral, banks now face increased difficulty in tracing and collecting overdue payments.

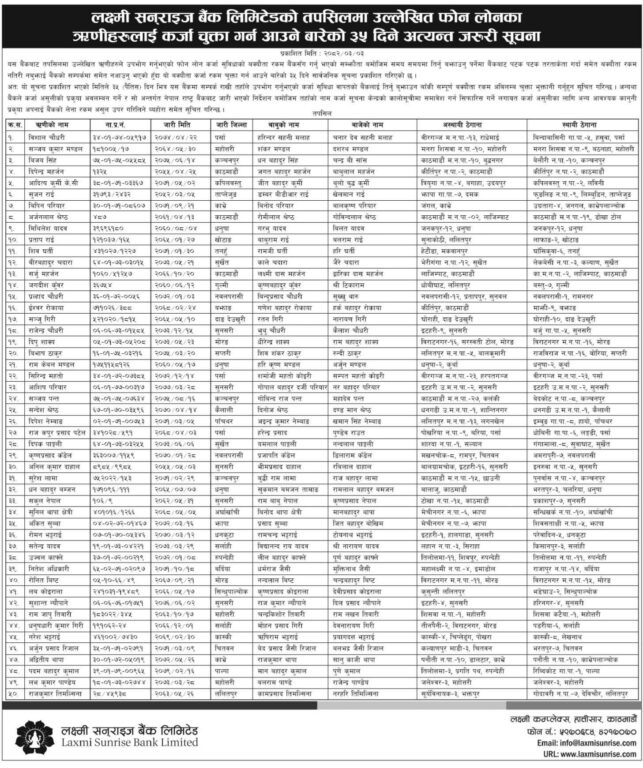

In a notable move, Laxmi Sunrise Bank has published the names of 50 phone loan defaulters. These individuals, identified as three-generation (legacy) borrowers, have reportedly failed to repay both principal and interest, and have not responded to the bank’s communication efforts.

The bank stated that despite repeated oral and written notices, these borrowers have not come forward to settle their debts. As a result, Laxmi Sunrise Bank has given a final notice, urging all listed borrowers to repay their loans within 35 days.

If the dues are not cleared within this timeframe:

- The names of these borrowers will be blacklisted in the Credit Information Bureau (CIB).

- The bank will initiate legal proceedings to recover the outstanding loan amounts.

About Us

About Us

Comment