Banking News – The traditional card issuing model, long dominated by banks operating proprietary systems, is undergoing a rapid transformation. Industry experts say the shift is being fueled by API-based, embedded setups and the emergence of new fintech players reshaping the value chain.

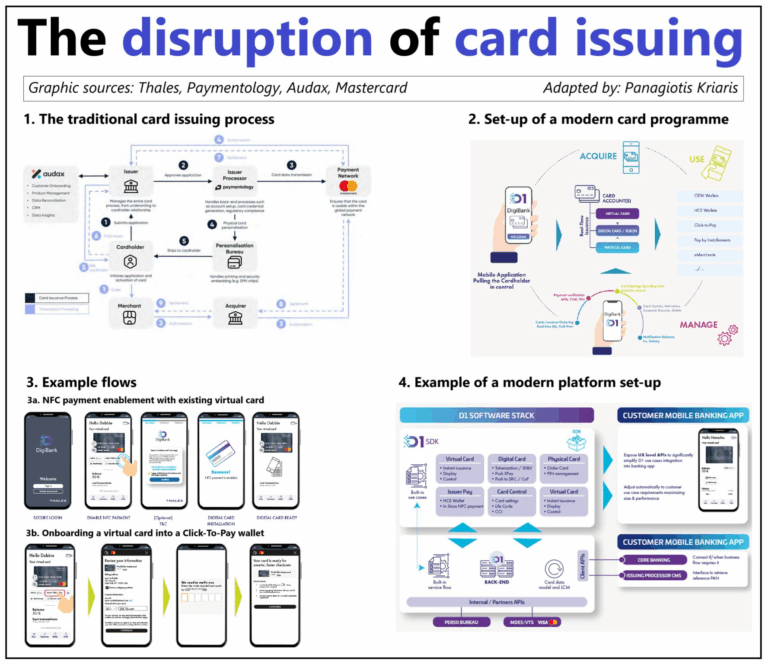

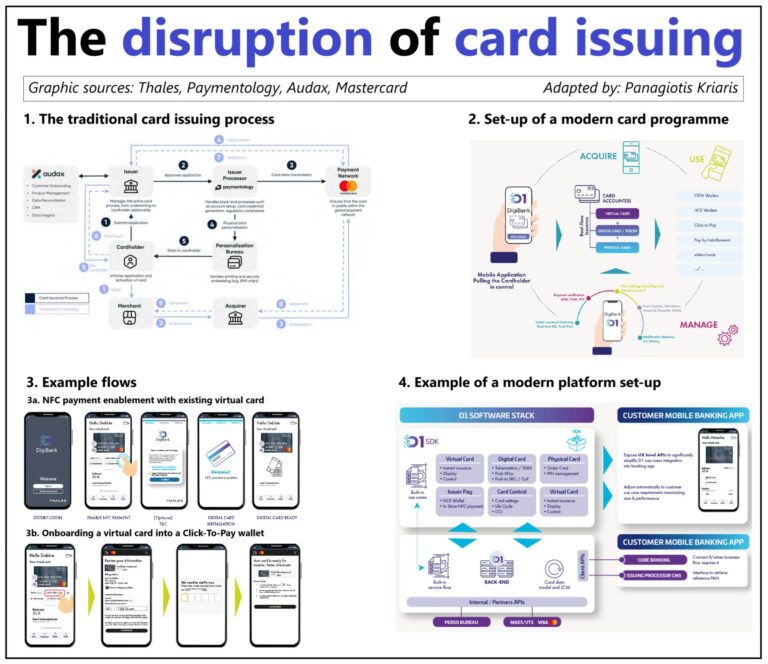

In the conventional system, banks managed the entire process in-house from card personalization to authorization, settlement, customer service, and fraud detection via their own processing centers. While effective in its time, this approach has been criticized for being rigid, costly, and resistant to customization.

“In today’s API economy, where companies across sectors are embedding financial flows into unrelated offerings, the old model is no longer sustainable,” experts note.

Enter Cards-as-a-Service (CaaS) a business model that mirrors the disruption previously seen in payment acquiring. Similar to Banking-as-a-Service (BaaS), CaaS allows businesses, from consumer brands and online marketplaces to gig economy platforms and neobanks, to issue branded payment cards without building complex back-end systems.

How CaaS Works:

- Cloud-based, modular architecture for scalability

- White-labeled and embedded solutions integrated via APIs

- Customizable controls such as spending limits and branded experiences

- Third-party providers managing card production, processing, and compliance

- Licensing through Electronic Money Institutions (EMIs)

- Flexible pricing models, including subscription or pay-as-you-go

- Advanced security through tokenization and encryption

- End-to-end management covering underwriting, authentication, and risk mitigation

Analysts highlight that just as modern payment processors enabled merchants to accept payments without direct bank integrations, CaaS providers now let businesses issue cards instantly, programmatically, and at scale decoupling the customer experience from the technical and regulatory infrastructure.

The result is a democratization of financial services, enabling even non-financial companies to offer sophisticated payment solutions.

About Us

About Us

Comment