Nepal is undergoing a historic transition toward a federal and secular republic. This represents a window of opportunity for the country to further reduce poverty, increase the income of the bottom 40 percent, and pursue its ambitious agenda of inclusive growth and accountable service delivery.

AT A GLANCE

In 2018, the World Bank came up with its Country Partnership Framework (CPF) covering the five-year period of FY2019-2023. Coincidentally, this came at a time of historic transformation in Nepal, as a new government took up office in February 2018. The signing of the Comprehensive Peace Agreement in 2006 ended a 10-year conflict that came at a significant cost of lives and foregone economic development. Since then, Nepal has gone through lengthy and complex transitions towards a new Constitution in 2015 that set in place a federal structure. By the end of 2017, elections were successfully held at the federal, state, and local tiers. There is a newfound optimism for greater political stability, inclusion, good governance and sustainable growth. The new federal structure presents unprecedented opportunities for Nepal to reset its development storyline, as outlined in the Systematic Country Diagnostic (SCD).

At the same time, the shift to federalism poses new challenges and source of fragility, given the heightened popular aspirations and expectations. Key challenges include the need to clarify the functions and accountabilities of the federal, state, and local governments; deliver basic services and maintain infrastructure development; create a conducive environment for the private sector; and address governance weaknesses that may worsen in the early years of the new federal system.

LENDING

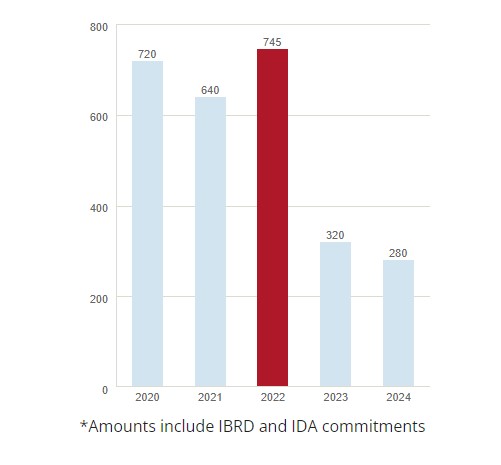

Nepal: Commitments by Fiscal Year (in millions of dollars)*

COUNTRY CONTEXT

In Nepal, the government formed in 2018 was preceded by elections for all three tiers (local, state and federal) of the state architecture defined by the new constitution, marking a protracted but successful conclusion of a political transition that began with the signing of the Comprehensive Peace Agreement in November 2006. State governments largely mirror the coalition at the center. At the sub-national level, funds, functions and functionaries hitherto managed by the central, district and village authorities are moving to the seven new states and 753 local governments for which new legislation, institutions and administrative procedures are being formalized as constitutionally prescribed. Meanwhile, the central level authority is being streamlined with a focus on oversight. These exercises at state restructuring are expected to result in improved outreach and service delivery but will likely take time before they become fully operational.

Significant adjustments need to be made to the government structure. They include amending over 400 existing acts, restructuring the civil service at all levels, devolving fiscal management, and determining the division of funds, functions, and functionaries between various levels of government. State restructuring on this scale is uncharted territory for Nepal and smoothening the transition from the previous unitary system to the new federal one will remain a daunting task. The new system, in principle, provides opportunities to decentralize development benefits and make service delivery more effective and accountable. However, the risks of jurisdictional overlap between the three tiers of government, lack of clarity and coherence between policies and devolved powers, and duplication of efforts will remain high during the coming few years. Key aspects of the new system require further definition and may continue to be contested by different population groups.

RECENT ECONOMIC DEVELOPMENTS

Nepal’s economy saw improved growth in the first half of FY24 (H1FY24) compared to FY23, supported by the services sector, helping its economic growth rebound from a low of 1.9 percent in FY23 to a forecast of 3.3 percent in FY24. Accommodation and food services led the way, fueled by a significant rise in tourist arrivals. Financial and insurance activities also expanded, although there was a contraction in wholesale and retail trade. The industrial sector contributed to growth as well, supported by higher hydroelectric production. In agriculture, there was an increase in paddy production, aided by improved seed availability and favorable weather conditions.

Private consumption drove growth on the domestic demand side, supported by a substantial increase of remittance inflows. However, since H1FY21, remittances growth has not supported higher imports of consumption goods. Private investment remained sluggish, as evidenced by decreased imports of capital and intermediate goods. On the other hand, public consumption and investment contracted, driven by austerity measures and lower revenue collection.

The external position strengthened, as the current account balance recorded a surplus, fueled by rising remittances and a shrinking trade deficit. The half-year current account balance turned from a deficit of 0.7 percent of GDP in H1FY23 to a surplus of 2.7 percent of GDP in H1FY24, marking the first surplus in eight years. This turnaround stemmed from two key factors: a rise in remittance inflows, from 10.9 percent to 12.3 percent of GDP, and a narrowing trade deficit, which decreased from 13.2 percent to 11.6 percent of GDP. Imports declined, primarily due to lower import of goods. However, there was a surge in imports of electric cars, due to lower tax rate. Service imports surpassed pre-pandemic levels, driven by a rise in educational services. While exports of goods and services showed marginal growth, they remained below pre-pandemic levels, with notable expansions in international tourist arrivals and electricity exports.

Official remittance inflows reached an eight-year peak in H1FY24, driven by increased outmigration and currency depreciation. Government incentives for migrant workers further encouraged remittances to flow through official channels. As a result of higher remittance inflows, official foreign exchange reserves increased and reached 12.1 months of import cover by the end of H1FY24.

Nepal also experienced a notable improvement in its fiscal deficit, with the half-year deficit shrinking to 0.4 percent of GDP in H1FY24 (from 1.4 percent in the same period last year), primarily attributed to reduced spending. Recurrent and capital expenditure were reduced, as part of austerity measures to reflect revenue shortfalls. Half-year revenue fell to an eight-year low of 8.7 percent of GDP in H1FY24, mainly due to a decrease in non-trade revenues and lower VAT and income tax collections resulting from weakened domestic demand.

To mitigate the revenue shortfall, the government adjusted its FY24 budget downward through mid-term reviews, revising both revenue and spending targets. Moreover, there is also the need for improved budget execution efficiency, especially for sub-national governments whose budget execution rates have lagged the federal government’s. Despite a small increase in public debt, it remains moderate and sustainable, supported by a significant share of concessional external loans and prudent fiscal management.

Average consumer price inflation decreased from 8 percent year-on-year (y/y) in H1FY23 to 6.5 percent (y/y) in H1FY24, primarily attributed to declines in nonfood and services inflation. However, food and beverage inflation slightly increased, driven by cereal grain and spice inflation, partly due to India’s export restrictions on rice, offsetting declines in ghee and oil prices.

Nepal’s poverty rate fell due to migration and remittances, alongside consumption increases. The recent nationally household survey data from the Nepal Living Standard Survey 2022/23 shows a large decline in poverty from 25 percent to just 3.6 percent between 2011 and 2023 (using the 2011 National Poverty Line). The prosperity gap and inequality also reduced over the same period. However, challenges persist with a weak labor market and limited social assistance, posing risks amid economic and climate shocks.

The monetary policy stance remained cautiously accommodative in H1FY24. Despite a pick-up in inflation, the central bank adopted a more accommodative monetary policy, lowering the key interest rate by 1 percentage point to 5.5 percent in early December 2023. However, the recent rate cut in the policy rate below the inflation ceiling (6.5 percent) raises concerns regarding adherence to the central bank’s new monetary policy rule. Real interest rates on deposits turned positive, boosting deposit growth to 102.3 percent of GDP by the end of H1FY24. Private sector credit, however, contracted to 90.7 percent of GDP. This decline can be attributed to a) tighter regulation on working capital loans, b) high lending rates, and c) weak domestic demand.

The banking sector remained stable and profitable despite challenges. Overall, asset quality remained solid, but there were signs of deterioration. Nonperforming loans increased, with private commercial banks experiencing a larger relative rise. Average capital adequacy ratio remained above regulatory requirements, but pressures were observed, particularly with three private commercial banks falling below the regulatory minimum for core capital adequacy ratio. Liquidity increased, supported by remittance inflows, prompting the central bank to implement measures to absorb excess liquidity. Moreover, efforts were made to mitigate further decline in banks’ profitability through adjustments in loan loss provisions and restructuring of loans for select sectors.

Overall, H1FY24 data corroborated the structural challenges facing Nepal’s economy. On the fiscal front, it highlighted the need to strengthen the execution and efficiency of capital expenditure to boost economic growth, as well as the importance of reducing dependence on imports tax revenue. Sound and consistent monetary policy will also be key to boosting confidence and stimulating economic growth. Addressing the increasing level of non-performing loans in the financial sector is crucial to strengthen financial stability and support private investment. On the external side, the high dependency on remittance inflows exposes the country to external shocks. Thus, there’s a need to strengthen Nepal’s international competitiveness for other sources of external earnings, such as tourism and foreign direct investment, by boosting exports of goods.

Outlook, Risks, and Challenges

Nepal’s economic growth is set to rebound, from 1.9 percent in FY23 to a forecast 3.3 percent in FY24. Growth is then projected to further accelerate to 5 percent on average, over FY25-26. This recovery is largely attributed to the easing of monetary policy, assuming productive use of private sector credit. Additionally, reforms to improve business environment could attract more private investment, further boosting medium-term growth prospects.

The services sector is expected to be the key driver of growth in the coming years. Accommodation and food services are poised to benefit significantly from the rise in tourist arrivals. The ongoing construction of new five-star hotels and government policies supporting real estate loans are expected to further stimulate the accommodation sub- sector. Meanwhile, the industrial sector is expected to grow, buoyed by significant expansions in electricity generation capacity, fostering a more conducive environment for industrial activities. However, agricultural growth is projected to slow down due to various factors, including the outbreak of lumpy skin disease among livestock and a decrease in paddy production growth.

In FY24, consumer price inflation is expected to remain high at 6.7 percent, close to the central bank’s 6.5 percent ceiling, due to VAT exemptions removal, India’s food export restrictions, and increased paddy minimum support prices. However, inflation is forecasted to decline to 6 percent in FY25 and 5.5 percent in FY26, driven by global commodity price moderation and domestic price containment through monetary policy. Projected lower inflation in India may also help reduce domestic inflation via the currency peg, mitigating imported inflation.

The current account balance is forecasted to return to surplus in FY24, driven by robust remittance growth and a narrowing trade deficit, but is expected to narrow subsequently as remittances taper off and the trade deficit expands. The trade deficit is expected to improve in the medium term, falling below its FY23 level. This is due to a projected decline in goods imports in FY24, although imports are expected to rebound in FY25 and FY26. Goods exports, particularly in electricity, are expected to increase. While services exports could rise with tourism recovery, services imports may surpass exports due to continued emigration. Despite efforts to attract more foreign direct investment, inflows are likely to remain modest.

Nepal’s fiscal deficit is poised to decrease significantly from its peak in FY23 (about 6 percent of GDP), stabilizing around 3 percent of GDP in the medium term, despite a projected higher deficit in FY24 compared to the government’s revised forecast. Revenue is expected to rise to 20.1 percent of GDP by FY26, supported by robust GDP growth and increased goods imports. Meanwhile, spending is expected to increase to 22.8 percent of GDP by FY26, driven by enhanced execution of public investment. The National Project Bank’s integrated guidelines, introduced in March 2023, aim to streamline project development and prioritization, contributing to more effective capital spending by FY25. Financing for the fiscal deficit will likely come from external concessional borrowing and domestic sources. However, public debt is projected to decline to 40.8 percent of GDP by FY26 from its FY23 peak because of higher economic growth.

The forecast is subject to both domestic and external risks. Externally, geopolitical uncertainty could trigger a rise in commodity prices, impacting all sectors. A growth slowdown in partner countries might also lead to a drop in remittances and tourism, hindering economic growth. Persistent inflation expectations and lower domestic demand could further dampen economic activity. Natural disasters pose additional risks to sustaining welfare gains. Finally, frequent political changes, a top headwind for businesses for over a decade, could continue to deter private investment.

STRATEGY : THE WORLD BANK GROUP AND NEPAL

The World Bank Group (WBG) fielded its first economic mission to Nepal in 1963 to assess the country’s development prospects and challenges. It approved its first credit in 1969 for a telecommunications project.

After three consecutive Interim Strategies in FY 2007, 2009 and 2011, the WBG provided longer-term support through the Country Partnership Strategy (CPS) covering FY2014-2018. The CPS aimed to support Nepal’s aspirations for higher and more inclusive economic growth to help equalize opportunities across population groups.

Nepal is eligible for concessional financing support from the International Development Association (IDA). During the IDA17 period (17th replenishment of IDA covering FY2015-2017), the World Bank committed $1.2 billion. This amount included additional financing of $300 million from the IDA Crisis Response Window to respond to the emergency needs after the 2015 earthquake. During IDA18 period (FY2018-2020), Nepal may access approximately $1.3 billion in IDA financing. This includes additional financing from the IDA Exceptional Risk Mitigation Regime financing window.

In 2018, the World Bank Group operationalized its Country Partnership Framework (CPF) for Nepal, that covers a period of five years – FY2019 to FY2023. The overarching goal is to support Nepal’s new federal system that can deliver on higher sustained growth for poverty reduction, inclusive development, and shared prosperity. The new federal structure introduced by the 2015 Constitution presents unprecedented opportunities to reset Nepal’s development trajectory. There is a newfound optimism for greater political stability, inclusion, good governance and sustainable growth following the elections in 2017 and the establishment of a new government in early 2018.

The CPF prioritizes the following areas:

- Strengthening public institutions. The WBG will be explicit in its support to strengthening public institutions for effective economic management, service delivery, and public investment not only at national level, but at sub-national levels.

- Private sector led jobs and growth. The WBG will contribute to generating more and better jobs through private sector-driven growth, building on ongoing work to improve access to energy and connectivity, regulatory environment and financial sector stability.

- Inclusion and diversity. The WBG will work to achieve greater inclusion for the poor, vulnerable, and marginalized groups, with greater resilience against climate change, natural disasters, and other exogenous shocks.

Across all its activities, the World Bank will aim to achieve greater gender equity and inclusion, to ensure citizen engagement, to incorporate climate co-benefits, and to maximize financing for development.

WORLD BANK PROGRAM

In Nepal, the World Bank Group (WBG) includes the International Development Association (IDA), the concessionary lending arm; the International Finance Corporation (IFC), the private sector arm; and the Multilateral Investment Guarantee Agency (MIGA), the investment risk insurance arm.

The World Bank currently supports 25 active investment projects in Nepal with $2.4 billion in commitments from IDA and trust funds of which a significant portion is for policy reforms in the areas of fiscal decentralization, the financial sector, and the energy sector. The indicative resources available under IDA18 (FY2018-2020) are about $1.39 billion, including $300 million from the IDA Risk Mitigation Regime. IFC aims to commit about $800 million to $1.2 billion over the five-year period (FY19 to FY23). MIGA is actively seeking opportunities to support foreign private investment into Nepal.

In addition to financing investment projects, the World Bank is supporting the government’s policy reforms in fiscal management and the financial sector. For example, through development policy financing it has supported the restructuring of the banking sector, strengthening the sector’s legal and regulatory framework and improving transparency in the financial sector. The World Bank is also financing the government’s programs for healthcare reforms and education development.

The World Bank has provided a range of analytical and advisory support for policy reforms and economic and sector advice. One recent flagship report was “Climbing Higher: Toward a Middle-Income Nepal” that offered policy recommendations for escaping the low-growth trap. Together with UK’s Department for International Development (DFID) it also published “Moving Up the Ladder – Poverty Reduction in Social Mobility in Nepal.” Other World Bank analysis included reports on health insurance, education, nutrition and urban engagement. Twice a year, the World Bank issues the Nepal Development Update that reviews the state of Nepal’s economy.

After the 2015 earthquake, the WBG responded quickly and flexibly to finance emergency reconstruction, coordinating closely with other development partners. The World Bank restructured, reallocated or extended 12 existing IDA projects for recovery efforts. In parallel with the Japan International Cooperation Agency, it funded the Earthquake Housing Reconstruction Project ($200 million). The World Bank also administered a multi-donor trust fund ($10 million) that pooled resources from Canada, DFID, Switzerland, and USAID.

WORLD BANK – IFC COLLABORATION

The World Bank is working closely with the IFC to strengthen the environment for private sector investment and promote private sector growth. Nepal is one of the pilot countries for the WBG’s renewed efforts to maximize financing for development by crowding in private sector finance and to minimize public debt and contingent liabilities. The two institutions coordinate closely in the energy and financial sectors. In addition to the SCD, multiple joint analytical work is underway, including the Country Private Sector Diagnostic (CPSD) and the Infrastructure Sector Assessment Program (InfraSAP).

IFC Nepal focuses on private sector development through provision of financing and advisory services to companies to boost their competitiveness, while expanding financial inclusion and delivering sustainable infrastructure solutions. IFC’s current portfolio in Nepal is $57 million. The budget for advisory support aimed at creating bankable projects and building capacity stands at nearly $16 million.

IFC’s strategy focuses on addressing development gaps in financial inclusion, sustainable infrastructure, and competitiveness. IFC is supporting financial institutions and venture funds to expand access to finance for SMEs and individuals. With the World Bank, it has helped unlock barriers for new infrastructure projects, including the ground-breaking 216 MW Upper Trishuli-1 hydropower project that is expected to attract the largest single project foreign direct investment into Nepal.

Through its advisory services, IFC is working with the Government and the private sector on improving Nepal’s investment climate, enhancing regional connectivity and promoting investment in tourism.

MIGA

MIGA has coordinated with the World Bank and IFC to consider a guarantee support for the Upper Trishuli-1 Hydro Project. The Agency is ready to consider further projects across sectors as appropriate opportunities emerge.

About Us

About Us

Comment