Banking News – Several high-profile tech executives who supported former President Donald Trump, including donations to his campaign and inaugural fund, are now facing steep financial losses as a result of his tariff-driven economic policies.

Executives from major firms such as Meta, Apple, Google, Tesla, and Amazon—many of whom attended Trump’s inauguration and met with him at Mar-a-Lago—have collectively seen their companies lose nearly $1.8 trillion in market value since the start of 2025. The downturn comes despite a recent market rebound prompted by Trump’s temporary halt on some proposed tariffs.

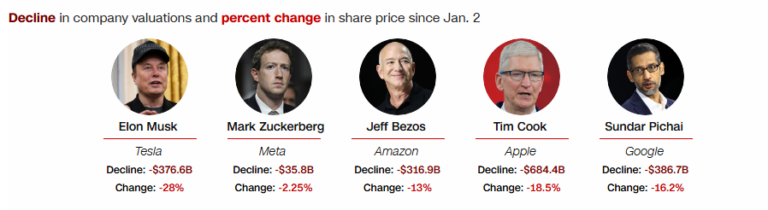

The steep decline in valuations has also significantly impacted the personal fortunes of these tech titans. According to Bloomberg’s Billionaires Index, Tesla CEO Elon Musk alone has seen his net worth drop by $143 billion this year, driven largely by a 28% fall in Tesla shares. The company’s market capitalization has dropped by $376.6 billion, as of April 9.

Musk, a vocal Trump supporter who has donated over $290 million to his reelection efforts, had previously warned that escalating tariffs could deal a “significant” blow to Tesla. Analysts now echo his concerns. Dan Ives of Wedbush Securities described the current environment as an “Armageddon” for the tech sector—one of the toughest investment landscapes in decades.

Meta, led by Mark Zuckerberg, was among the first major companies to donate $1 million to Trump’s inauguration. Since the beginning of the year, Meta’s valuation has dropped by $35.8 billion, and Zuckerberg’s net worth has fallen by $26.5 billion. Notably, Zuckerberg made several pro-Trump moves within Meta, including elevating Republican figures and reducing content moderation policies.

Amazon founder Jeff Bezos, who publicly praised Trump’s political comeback following the 2024 election, has also been affected. Amazon’s shares are down 13% year-to-date, cutting $316.8 billion from the company’s market value. Bezos has lost $47.2 billion in personal wealth.

Google and Apple, which each contributed $1 million to Trump’s inaugural fund and held discussions with the former president on regulatory issues, are also facing consequences. Google’s stock is down 16.2%, reducing its valuation by $386.7 billion, while Apple’s shares have fallen 18.5%, wiping $684 billion from its market capitalization.

Apple, in particular, is vulnerable due to its global supply chain. The company manufactures many of its products in China, Vietnam, and India—regions now targeted by Trump’s aggressive trade policies. Despite announcing a $500 billion investment in US-based facilities, analysts believe the impact of tariffs will significantly weigh on the company’s future earnings.

A report by UBS warned that prolonged uncertainty surrounding tariff policies could slash tech earnings by up to 25%, a stark contrast to the industry’s recent growth fueled by artificial intelligence advancements.

While tech giants previously sought exemptions from Trump’s tariffs during his first term, analysts now suggest the current geopolitical and economic climate makes such outcomes far less predictable.

“While it is difficult to estimate the effects,” noted Moody’s Ratings in a recent analysis, “we believe no technology subsector will go unharmed.”

Representatives for Meta, Apple, Amazon, Tesla, and Elon Musk did not respond to requests for comment. Google declined to comment.

About Us

About Us

Comment